In simple terms, the company is creating more sales per dollar of assets, indicating efficient asset management. In the realm of financial analysis, the Asset Turnover Ratio plays a critical role. It provides significant insights into how efficiently a company uses its assets to generate sales. Sally’s Tech Company is a tech start up company that manufactures a new tablet computer. Sally is currently looking for new investors and has a meeting with an angel investor. The investor wants to know how well Sally uses her assets to produce sales, so he asks for her financial statements.

Asset Turnover Ratio: Understanding Its Significance and Limitations in Financial Analysis

Asset turnover ratios vary across different industry sectors, so only the ratios of companies that are in the same sector should be compared. For example, retail or service sector companies have relatively small asset bases combined with high sales volume. Meanwhile, firms in sectors like utilities or manufacturing tend to have large asset bases, which translates to lower asset turnover. Sometimes investors also want to see how companies use more specific assets like fixed assets and current assets. The fixed asset turnover ratio and the working capital ratio are turnover ratios similar to the asset turnover ratio that are often used to calculate the efficiency of these asset classes.

Asset Turnover Ratio Normal Value and Industry Benchmark

Check out our debt to asset ratio calculator and fixed asset turnover ratio calculator to understand more on this topic. The following article will help you understand what total asset turnover is and how to calculate it using the total asset turnover ratio formula. We will also show you some real-life examples to better help you to understand the concept. Your business’s asset turnover ratio indicates whether or not you’re efficiently managing—and optimizing—your assets to produce the highest volume of sales possible. You want to maximize your output with as little input as possible, so this is a crucial number to know.

Everything You Need To Master Financial Modeling

The Asset Turnover Ratio is a performance measure used to understand the efficiency of a company in using its assets to generate revenue. It measures how effectively a company is managing its assets to produce sales and is a key indicator of operational efficiency. A higher ratio suggests that the company is using its assets more effectively to generate revenue.

Company

- This is not considered good for the company because it indicates that the company’s total assets cannot produce enough revenue at the end of the accounting period (usually a year).

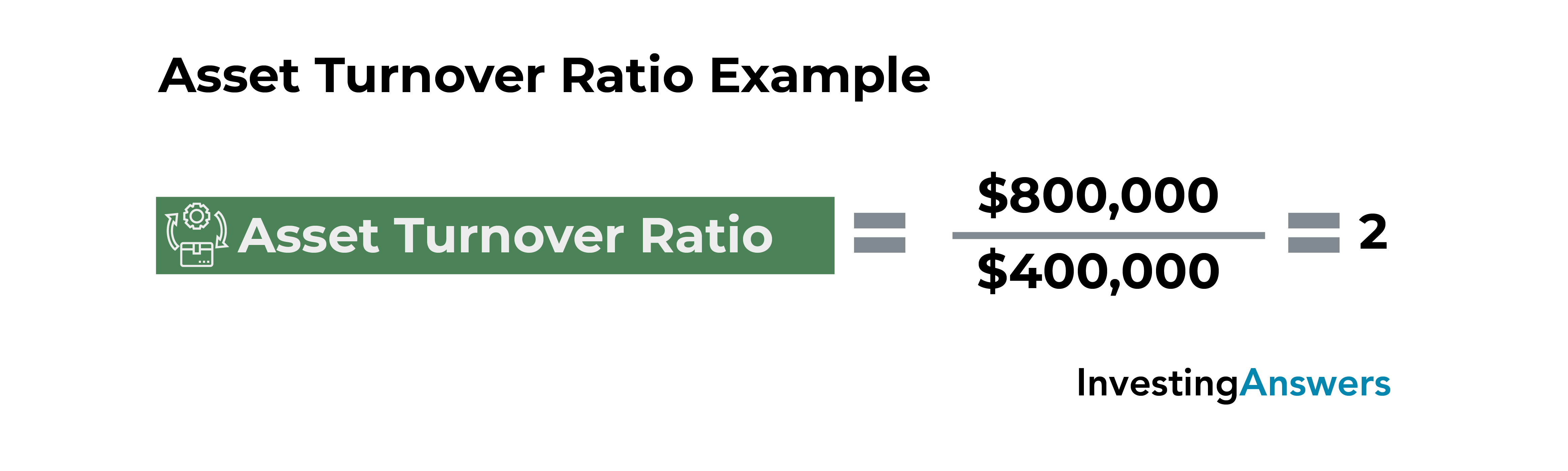

- The formula to calculate the total asset turnover ratio is net sales divided by average total assets.

- A higher ratio is generally favored as there is the implication that the company is more efficient in generating sales or revenues.

- That is, the ratio interprets how efficiently a company can use its assets to generate revenue.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Eliminate hours of searching for specific data points buried deep inside company material. Companies should strive to maximize the benefits received from their assets on hand, which tends to coincide with the objective of minimizing any operating waste.

What is a good total asset turnover ratio?

This is not considered good for the company because it indicates that the company’s total assets cannot produce enough revenue at the end of the accounting period (usually a year). However, this interpretation and conclusion still depend on the average asset turnover ratio of the industry what is a perpetual inventory system definition and advantages to which the company belongs. Other business sectors like real estate normally take long periods of time to convert inventory into revenue. Hence, the industry-wide asset turnover ratio is usually low even though real estate transactions may result in high-profit margins.

If you’re a small business looking for business financing, or applying for any type of credit product, it’s possible that this ratio could come into play during the application process. That’s because this ratio gives creditors a direct line of sight into whether or not your company is optimally managed. This figure represents the average value of both your long- and short-term assets over the past two years.

It also depends on the ratio of labor costs to capital required, i.e. whether the process is labor intensive or capital intensive. Though ABC has generated more revenue for the year, XYZ is more efficient in using its assets to generate income as its asset turnover ratio is higher. XYZ has generated almost the same amount of income with over half the resources as ABC. Suppose company ABC had total revenues of $10 billion at the end of its fiscal year.

However, it’s important to consider asset turnover in conjunction with other financial metrics and qualitative factors to get a more complete picture of the company’s financial health. Your asset turnover ratio is an equation to help you figure out how you’re using your assets to generate sales. In much simpler terms, by finding your asset turnover, you can figure out how many dollars of sales you’re generating for every dollar in the value of assets you have. This accounting principle is a peek into the efficiency of your business—whether or not you’re using the assets you have, both fixed and current, to generate sales. If the asset turnover ratio of a company is less than 1, it is said to have a low ratio.

Like with most ratios, the asset turnover ratio is based on industry standards. To get a true sense of how well a company’s assets are being used, it must be compared to other companies in its industry. This ratio measures how efficiently a firm uses its assets to generate sales, so a higher ratio is always more favorable. Lower ratios mean that the company isn’t using its assets efficiently and most likely have management or production problems. The asset turnover ratio tends to be higher for companies in certain sectors than others.