Accrued vacation is a type of accrued expense that incurs through the passage of time that the employees perform the work for the company. Likewise, if the company does not make the journal entry for the accrued vacation at the period-end adjusting entry, both expenses and liabilities will be understated. vacation accrual journal entry Assuming you have correclt figured out all the accruals and entitlements, then all you need to do is adjust the ‘unused vacation payable’ liability account to the correct year-end balance. Accountants include the accrual for compensated absences with other current liabilities on the balance sheet.

- You need to track accrued vacation time diligently and reflect it accurately on your balance sheet.

- The best frequency for your business depends on its size, complexity, and internal processes.

- Once paid, the liability disappears from the balance sheet, and the accrued vacation amount appears in the cash flow statement as a cash outflow.

- Other common time frames to record unused vacation leaves are once per fiscal year or on the employee’s hire date.

- You are responsible for calculating vacation accrual and creating a vacation accrual journal entry to update and balance your books.

How To Correctly Adjust Vacation Accrual For Employees

And managers should certainly consider the preferences of employees. The accrual for compensated absences should take into account the substance of the employer’s vacation and sick policies, rather than their form. If you use cash accounting, you won’t record accrued expenses because you’ll only record the expenses once the employee is paid in July. But with accrual, the expenses show up on your income statement in June as your employee purchases the supplies. Vacation pay is calculated using an employee’s most recent pay rate. When you raise an employee’s pay, you must add the incremental amount of vacation pay to the accrued vacation liability.

Legal and Compliance Risks

Book a demo today to see what running your business is like with Bench. Not sure where to start or which accounting service fits your needs? Our team is ready to learn about your business and guide you to the right solution. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

FAR CPA Practice Questions: Debt Covenant Compliance Calculations

Employers that are accumulating significant liabilities should begin to plan for employees to redeem their compensated absences in a way that will not adversely affect operations. For example, they may be given 80 hours of PTO (equal to 10 vacation days) at the beginning of the year, to use throughout the calendar year. Once their lump sum is given; they don’t add PTO with more time worked.

What happens when an employee gets a salary increase?

If you’d like to discuss optimizing your review process, reach out to FinOptimal through our contact form. By recording accrued vacation, ABC Corp ensures that its financial statements accurately reflect its financial obligations and the expenses incurred during the accounting period. From an accounting perspective, it’s essential to record accrued vacation as a liability to accurately reflect the company’s financial obligations. This also ensures that the financial statements provide a clear picture of the company’s financial health for management, investors, and other stakeholders. Inaccurate financial statements can misrepresent your company’s financial health, potentially impacting investor confidence and access to funding. Miscalculations can also lead to disputes with employees regarding their earned time off, affecting morale and potentially leading to legal issues.

This ensures the expense is recognized in the same period as the related payroll costs, providing a more accurate picture of labor costs for each period. Recording accruals at the end of the fiscal year is another common practice. This gives a comprehensive overview of the vacation liability at year-end, essential for accurate financial reporting. Some companies record accruals based on each employee’s hire date, though this can become administratively complex as the company grows. Recording a vacation accrual journal entry at least annually is a good starting point.

You can find detailed information on ASC 710 on the FASB website and other reputable accounting resources online. Remember to also consult state-specific regulations, as these can impact how you manage vacation accrual and payouts. Your state’s Department of Labor website is a good starting point for finding relevant state laws.

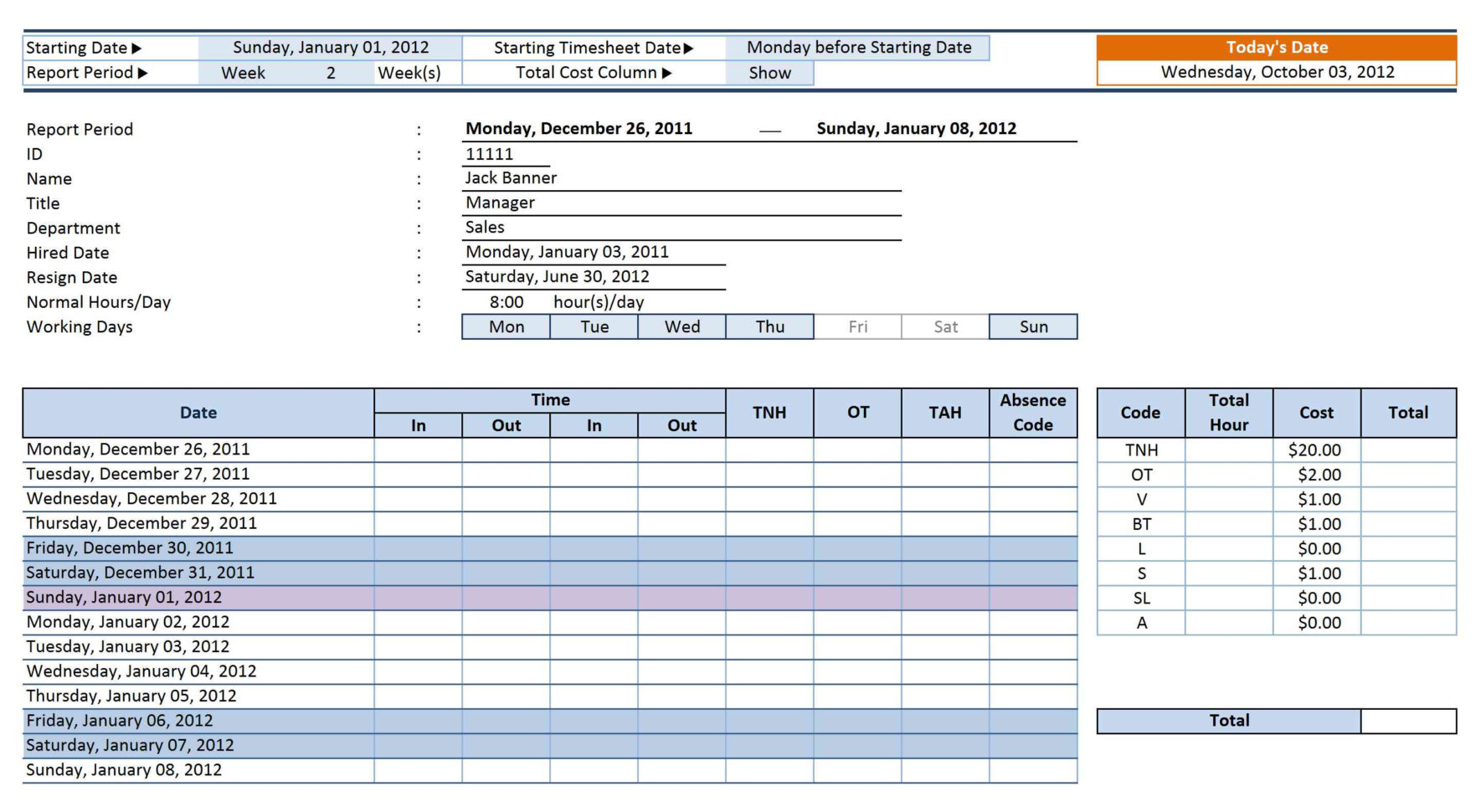

The company usually estimates the accrued vacation based on past experience. Likewise, the estimation may be different from an actual vacation payment itself. However, as it is considered an accounting estimate, there is no requirement for the company to make retrospective adjustments. You will need to specify the GL accounts, pay period, start, and end dates. There is also a space where you can put an adjustment for an employee.

Furthermore, companies with operations outside the United States must be mindful to follow the laws of the countries where their employees work. Prepaid expenses are an asset on your balance sheet as it reflects a future value—multiple months of a social media management tool—for your business. Then every month, you need to make an adjustment to reflect the monthly expense of the subscription.

If there are no rate changes you can leave the end date field blank. You only need to use the end date field if the employee has a change in vacation days or wages, or is no longer with the company. In the latter case you will also want to set their status to Inactive. If you do not want to track dollars accrued then you can simply leave the wage field blank. This template will allow you to track vacation dollars and hours even if there are wage or vacation rate changes.

According to the Bureau of Labor Statistics, 76 percent of workers in private industry enjoy paid vacation time, making it one of the most common benefits offered by small businesses. While vacation time is highly coveted, an employee typically does not use it in the same period that it is awarded or earned. To determine when, how and what to accrue for unused vacation time, follow these guidelines. In the above example, assume that the company has an effective tax rate of 25%. Accrued vacation is an accounting concept that refers to the amount of vacation time that employees have earned but have not yet taken or been paid for.