Changes in long-term debt and assets tend to affect the D/E ratio the most because the numbers involved tend to be larger than for short-term debt and short-term assets. If investors want to evaluate a company’s short-term leverage and its ability to meet debt obligations that must be paid over a year or less, they can use other ratios. The debt to asset ratio is used to assess the proportion of a company’s assets financed through debt, indicating its leverage and financial risk. In the consumer lending and mortgage business, two common debt ratios used to assess a borrower’s ability to repay a loan or mortgage are the gross debt service ratio and the total debt service ratio.

Formula and Calculation of the D/E Ratio

Upon plugging those figures into our formula, the implied D/E ratio is 2.0x. Pete Rathburn is a copy editor and fact-checker 7 most important kpis to track as a small business with expertise in economics and personal finance and over twenty years of experience in the classroom.

Create a Free Account and Ask Any Financial Question

This is a particularly thorny issue in analyzing industries notably reliant on preferred stock financing, such as real estate investment trusts (REITs). These balance sheet categories may include items that would not normally be considered debt or equity in the traditional sense of a loan or an asset. High debt to asset ratio may indicate that the company has high leverage, meaning the assets of the company are funded with more debt. When revenues are high, the company can easily amplify its profits, but when the revenue is low, this high leverage may lead to a strain on the company’s financials. On the other hand, a low debt to asset ratio might imply that the company relies less on debt and would have more flexibility to absorb any financial shocks.

Debt to Equity Ratio Calculation Example

While a useful metric, there are a few limitations of the debt-to-equity ratio. This figure means that for every dollar in equity, Restoration Hardware has $3.73 in debt. As noted above, the numbers you’ll need are located on a company’s balance sheet. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. In addition, the reluctance to raise debt can cause the company to miss out on growth opportunities to fund expansion plans, as well as not benefit from the “tax shield” from interest expense.

Step 1: Identify Total Debt

If earnings don’t outpace the debt’s cost, then shareholders may lose and stock prices may fall. A debt-to-equity-ratio that’s high compared to others in a company’s given industry may indicate that that company is overleveraged and in a precarious position. Investors may want to shy away from companies that are overloaded on debt. When using the D/E ratio, it is very important to consider the industry in which the company operates. Because different industries have different capital needs and growth rates, a D/E ratio value that’s common in one industry might be a red flag in another.

Debt to Equity Ratio Formula & Example

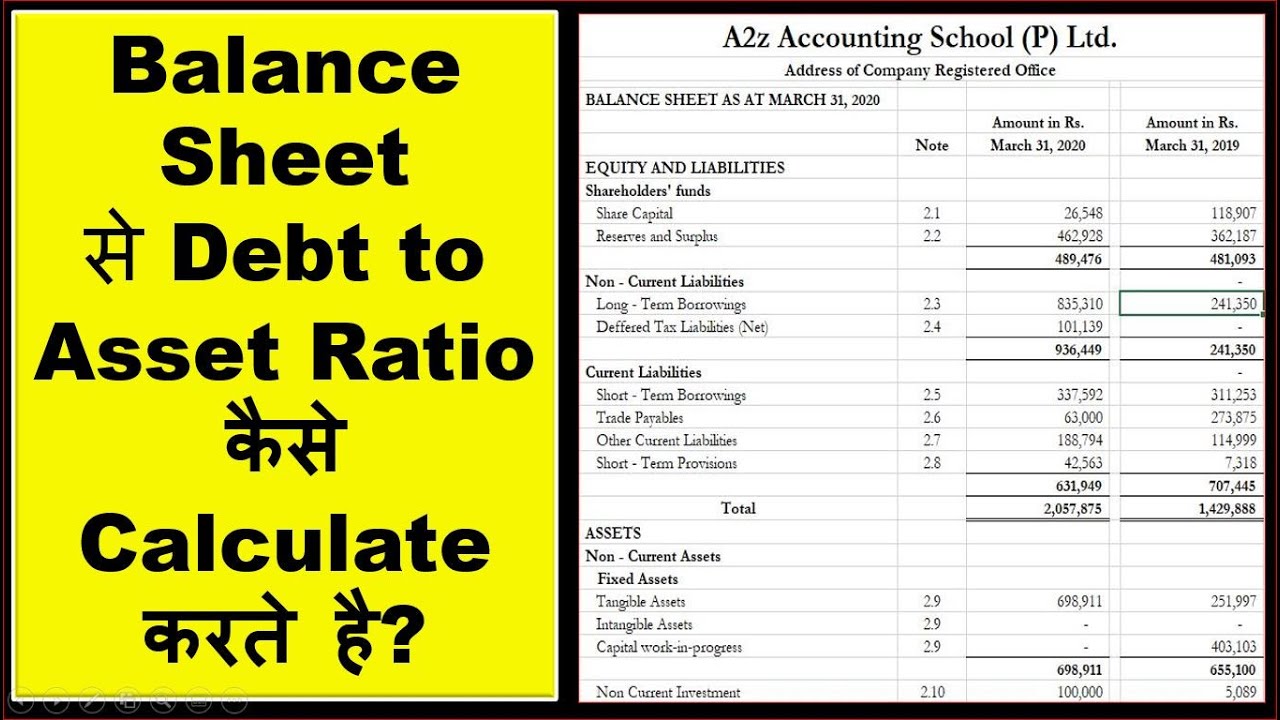

Over this period, their debt has increased from about $6.4 billion to $12.5 billion (2). You can find the inputs you need for this calculation on the company’s balance sheet. In most cases, liabilities are classified as short-term, long-term, and other liabilities.

Industries like utilities and telecommunications often have higher debt-to-asset ratios due to capital-intensive operations, while sectors such as technology may exhibit lower ratios. In fact shareholders can make more from projects funded by debt rather than equity. This is because the cost of debt is lower than the cost of equity – so the return on equity is better. The higher the number, the greater the reliance a company has on debt to fund growth. Let’s look at a few examples from different industries to contextualize the debt ratio.

- Over time, the cost of debt financing is usually lower than the cost of equity financing.

- There is no universally agreed upon “ideal” D/E ratio, though generally, investors want it to be 2 or lower.

- For example, utility companies might be required to use leverage to purchase costly assets to maintain business operations.

So, the debt-to-equity ratio of 2.0x indicates that our hypothetical company is financed with $2.00 of debt for each $1.00 of equity. ✝ To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. It’s easy to get started when you open an investment account with SoFi Invest. You can invest in stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, and more. SoFi doesn’t charge commissions, but other fees apply (full fee disclosure here). In order to calculate the debt-to-equity ratio, you need to understand both components.